Security and Ease of Access

NEW SECURITY FEATURES ARE COMING

What does this mean for you?

If you use the Memorized Account feature to store your member login number, you will need to re-enter this information along with your personal access code (PAC) the first time you attempt to sign into Online Banking on April 19th, 2022 after the upgrades are complete. If you would like to re-memorize your login details, you will have the option to select Remember Me, to save your information for future sign-ins.

Ahead of the upgrade on April 19th, we recommend taking a moment to make sure you know your member login number and, if needed to make note of this number somewhere safe.

Questions?

If you’re unsure of your Online Banking login credentials or if you have any questions about the Two-Step update, please reach out to us.

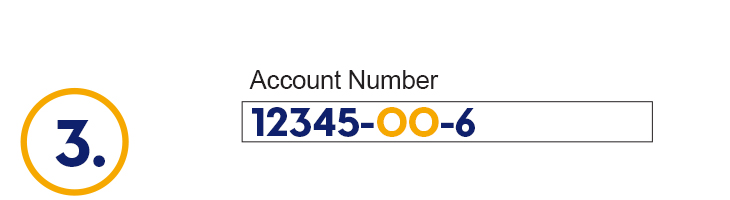

Find you Account Number

Find any of your Account Numbers from a past statement or a cheque for one of your accounts

Convert it to Member Number

Find the sixth and seventh digits of the eight digit number and replace them with 00

Log In

Use this number for the account Number filed when logging in to Online Banking or the Mobile Banking App

This number is often referred to as your Member Number

Protecting your accounts with Two-Step Verification

Maintaining the security of your personal information is critical for any online activity, particularly banking, as fraudsters continue to find more sophisticated ways to access sensitive information.

Consolidated Credit Union is regularly working to introduce safeguards, including technology, to assist in protecting your personal and financial information.

On April 19th, we will launch our latest enhancements to Member Direct Online Banking, Two-Step Authentication. This new industry-wide standard helps to ensure safe and secure logins to Online Banking. Simply put, Two-Step Authentication adds a second step in your usual login process, which adds an extra degree of protection to the standard single-step technique, which relies solely on a password to confirm your sign-in.

On April 19th, things will look slightly different when you log in to your Online Banking. As you usually do, to access your Online Banking, you will enter your Member Login) along with your Personal Access Code (PAC). The new Two-Step Verification security measure within Online Banking will replace the current use of security question. During higher-risk logins such as when you log into Online Banking from a new device or from a different IP address, you will now be sent a short, one-time-use unique code that you must enter to confirm your identity before continuing into your online banking.

Once we launch Two-Step Verification on April 19th, the setup is simple. As you usually do to access Online Banking, you will click the login button on the home screen of online banking, and you will be prompted to put in your Member Login and your Personal Access Code (PAC) (Click her for more information on Memorized Accounts Link) You will want to ensure you know what your member login number. The new Two Step Verification security feature registration page will appear. You will be prompted to provide either your mobile phone number or email address where the one-time unique code will be sent to you. Once you retrieve the code from a text message or email, you will put the code in on the registration screen and click continue. Your registration is now completed.

This extra step of protection will add just a few seconds to the MemberDirect Online Banking login process. However, having a second authentication step makes it so much more difficult for a hacker or a thief to break into your online accounts.

FREQUENTLY ASKED QUESTIONS

Outside of regular business hours, you can contact Sonoma Online Technical Support at 1-888-CREDIT-U (273-3488) and they will be happy to help you.

If you’re just signing up for 2-Step Verification and haven’t received a code, you may also want to confirm that you have input your mobile phone number or email address correctly. If you find an error, you will have the option to back up a step and correct your information.